The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing.

IFRS 16 Leases

You need to Sign in to use this feature

IFRS 16 is effective for annual reporting periods beginning on or after 1 January 2019, with earlier application permitted (as long as IFRS 15 is also applied).

The objective of IFRS 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the amount, timing and uncertainty of cash flows arising from leases. To meet that objective, a lessee should recognise assets and liabilities arising from a lease.

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments.

Standard history

In April 2001 the International Accounting Standards Board (Board) adopted IAS 17 Leases , which had originally been issued by the International Accounting Standards Committee (IASC) in December 1997. IAS 17 Leases replaced IAS 17 Accounting for Leases that was issued in September 1982.

In April 2001 the Board adopted SIC‑15 Operating Leases—Incentives , which had originally been issued by the Standing Interpretations Committee of the IASC in December 1998.

In December 2001 the Board issued SIC‑27 Evaluating the Substance of Transactions Involving the Legal Form of a Lease . SIC‑27 had originally been developed by the Standing Interpretations Committee of the IASC to provide guidance on determining, amongst other things, whether an arrangement that involves the legal form of a lease meets the definition of a lease under IAS 17.

In December 2003 the Board issued a revised IAS 17 as part of its initial agenda of technical projects.

In December 2004 the Board issued IFRIC 4 Determining whether an Arrangement contains a Lease . The Interpretation was developed by the Interpretations Committee to provide guidance on determining whether transactions that do not take the legal form of a lease but convey the right to use an asset in return for a payment or series of payments are, or contain, leases that should be accounted for in accordance with IAS 17.

In January 2016 the Board issued IFRS 16 Leases . IFRS 16 replaces IAS 17, IFRIC 4, SIC‑15 and SIC‑27. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases.

In May 2020 the Board issued Covid-19-Related Rent Concessions , which amended IFRS 16. The amendment permits lessees, as a practical expedient, not to assess whether rent concessions that occur as a direct consequence of the covid-19 pandemic and meet specified conditions are lease modifications. Instead, the lessee accounts for those rent concessions as if they were not lease modifications.

In August 2020 the Board issued Interest Rate Benchmark Reform―Phase 2 which amended requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to:

- changes in the basis for determining contractual cash flows of financial assets, financial liabilities and lease liabilities;

- hedge accounting; and

- disclosures.

The Phase 2 amendments apply only to changes required by the interest rate benchmark reform to financial instruments and hedging relationships.

In September 2022, the Board issued Lease Liability in a Sale and Leaseback , which added subsequent measurement requirements for sale and leaseback transactions.

Other Standards have made minor consequential amendments to IFRS 16, including Amendments to References to the Conceptual Framework in IFRS Standards (issued March 2018).

Related active projects

Sale and Leaseback of an Asset in a Single-Asset Entity (IFRS 10 and IFRS 16)

Related completed projects

Definition of a Lease—Shipping Contract (IFRS 16 Leases)

Definition of a Lease—Substitution Rights (IFRS 16)

Economic Benefits from Use of a Windfarm (IFRS 16)

IBOR Reform and its Effects on Financial Reporting—Phase 2

IFRS 16 and covid-19

IFRS Accounting Taxonomy Update—Amendments to IFRS 16 and IAS 1

IFRS Taxonomy Update—Covid-19-Related Rent Concessions (Amendment to IFRS 16)

IFRS Taxonomy Update—Interest Rate Benchmark Reform—Phase 2

Lease Incentives (Amendment to Illustrative Example 13 accompanying IFRS 16)

Lease Liability in a Sale and Leaseback

Lease Term and Useful Life of Leasehold Improvements (IFRS 16 Leases and IAS 16 Property, Plant and Equipment)

Lessee’s Incremental Borrowing Rate (IFRS 16 Leases)

Lessor Forgiveness of Lease Payments (IFRS 9 and IFRS 16)

Non-refundable Value Added Tax on Lease Payments (IFRS 16)

Sale and Leaseback with Variable Payments (IFRS 16)

Subsurface Rights (IFRS 16)

Related IFRS Standards

IAS 17 Leases

IAS 36 Impairment of Assets

Implementation support

Your privacy.

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Recognition and Measurement of Leases (IFRS 16)

Last updated: 15 February 2024

At the commencement of a lease, a lessee recognises the following:

- Right-of-use (RoU) asset representing its right to use the underlying leased asset throughout the lease term, and

- Lease liability representing its obligation to make lease payments.

The RoU asset is initially measured at cost, primarily comprising of an amount equivalent to the recognised lease liability, and any initial direct costs . The subsequent measurement involves applying depreciation and assessing impairment charges.

On the other hand, the lease liability is initially measured at the present value of lease payments. These primarily include fixed and certain variable lease payments. The subsequent measurement of the lease liability is impacted by the accumulation of interest, scheduled repayments, and remeasurements that reflect any lease reassessments or modifications.

Let’s dive in.

Initial measurement of the right-of-use asset

Components of the right-of-use asset.

The right-of-use asset is measured at cost at the commencement date. As outlined in IFRS 16.24, the RoU cost includes:

- An amount equivalent to the lease liability on initial recognition,

- Lease payments made on or before the lease’s commencement date, less any lease incentives received,

- Any initial direct costs incurred by the lessee; and

- An estimate of costs expected to be incurred by the lessee for dismantling and removing the underlying asset, restoring the site where it is located or restoring the underlying asset to the condition stipulated by the lease terms and conditions, excluding those costs related to producing inventories.

Example: Initial measurement of the right-of-use asset and lease liability

Let’s explore an example to illustrate the initial measurement of a lease based on the following assumptions:

- Commencement date: 1 January 20X1

- Discount rate: 5%

- Initial direct costs: $20,000

- Lease incentives: $5,000

- Upfront lease payment made before lease commencement date: $50,000

Initially, it’s essential to calculate the present value of the lease liability. This is done by discounting future lease payments to the lease commencement date. A handy tool for this is the XNPV spreadsheet function, producing a present value of future lease payments amounting to $355,353. Please refer to the included Excel file to view all calculations related to this example.

With the lease liability established, we can then determine the right-of-use asset, which stands at $420,353:

The subsequent lease liability and RoU accounting schedules are presented below.

Each year, the lease liability increases due to the unwinding of the discount (charged as finance costs in P/L) and decreases with each payment made:

The carrying amount of the RoU asset decreases with depreciation charged each year:

As we can see, total lease payments amount to $515,000 (including initial direct costs, lease incentives, and the upfront lease payment). The total expense recognised during the lease term also amounts to $515,000, divided between depreciation expense ($420,353) and discounting expense ($94,647).

It’s worth noting that in most lease agreements, payments are made monthly, often mid-month. As such, I’ve created an additional Excel file showcasing the recognition and measurement of a lease that involves monthly payments .

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and if it turns out not to be right for you, you can unsubscribe with just one click.

Example: Rent-free period

Occasionally, a lease might start with a rent-free period. Though these periods are sometimes labelled as ‘lease incentives,’ it’s important to note that they don’t meet the definition of lease incentives in IFRS 16. Rent-free periods are, in essence, a way of distributing lease payments throughout the lease term. As such, the IFRS 16 requirements lead to depreciation and interest charges being spread across the lease period, including rent-free periods, without any manual adjustments to the general recognition model.

Here’s an example of a 2-year lease commencing on 1 January 20X1 with a quarterly rent of $30,000 paid upfront, but with the first two quarters being rent-free. The discount rate in this example is 4%. For a more detailed explanation of how to account for a typical lease, please refer to the previous example .

In this case, assume that there are no initial direct costs or lease incentives received, so the RoU asset at initial recognition equals the lease liability’s initial measurement, totalling $172,272. Please refer to this Excel file for the calculations.

Subsequent accounting is identical to a lease without rent-free periods. The RoU asset is depreciated each year, and the interest expense is accrued on the lease liability. The only difference, compared to a lease without any rent-free periods, concerns lease liability repayments as there aren’t any during the first two quarters. Consequently, the carrying amount of a lease liability increases during these rent-free periods due to accrued interest (discount).

Here’s the subsequent lease liability accounting:

As usual, the carrying amount of the RoU asset decreases each quarter with the depreciation charged:

Initial direct costs

Initial direct costs are incremental costs of obtaining a lease that would not have been incurred if the lease had not been obtained (IFRS 16 Appendix A). The concept of initial direct costs aligns closely with the definition of incremental costs of obtaining a contract in IFRS 15.

Examples of initial direct costs added to the cost of a right-of-use asset under IFRS 16.24(c) include:

- Commissions paid to employees or external agents who facilitated the lease agreement, provided that these are payable only upon the lease contract’s signing,

- Legal expenses such as stamp duties that are incurred during the signing of the contract.

However, not all direct costs can be incorporated in the cost of the RoU asset. These include:

- Overhead cost allocations,

- Advisory fees that are incremental but would be incurred regardless of whether a lease contract is ultimately signed.

There is also a category of initial direct costs about which IFRS 16 does not provide explicit guidance. This involves costs directly attributable to bringing a RoU asset to the location and condition necessary for it to be capable of operating in the manner intended by management, also known as ‘asset costs’ rather than ‘contract costs’. This is linked to IAS 16 , which explicitly permits the inclusion of such costs in the cost of property, plant and equipment (PP&E). The same approach can be applied to RoU assets, a perspective indirectly supported by IFRS 16.BC149.

Lease payments made at or before the commencement date

Lease payments made at or before the commencement date are excluded from the lease liability. However, they are incorporated into the measurement of right-of-use assets under IFRS 16.24(b).

Security deposits paid

Some lessors demand a security deposit that will be refunded when the leased asset is returned by the lessee. These deposits are considered a separate financial asset at amortised cost under IFRS 9. As these deposits often do not bear interest, their initial recognition ‘s fair value is less than the cash paid. This difference should be treated as an initial direct cost and added to the RoU asset (see a similar example with security deposit paid by a contractor).

Lease incentives

Lease incentives comprise payments or reimbursements made by a lessor to a lessee in connection with a lease (IFRS 16 Appendix A). These incentives are accounted for as a reduction of the RoU asset in accordance with IFRS 16.24(b).

Reimbursement of leasehold improvements

In 2020, the IASB amended Illustrative Example 13 to IFRS 16, clarifying that reimbursements of leasehold improvements could not be automatically classified as non-lease incentives. If these payments economically indicate reimbursement for improvements made to the lessor’s asset, then indeed – they are not lease incentives. Indicators that leasehold improvements benefit the lessor’s asset include:

- Leasehold improvements would be necessary for most entities to use the leased asset (e.g., installing walls in a building),

- Assets constructed during the leasehold improvement process are not specialised to the lessee’s needs,

- Economic useful life of leasehold improvements exceeds enforceable lease term.

Leasehold improvements are separately recognised under IAS 16. If the reimbursement is not classified as a lease incentive, it is treated as a reduction of their cost .

Conversely, if the leasehold improvements are considered an asset of the lessee, any reimbursement made by the lessor should be treated as a lease incentive and accounted for as a reduction of the right-of-use asset recognised under IFRS 16.

Initial measurement of the lease liability

Components of the lease liability.

The lease liability should be initially recognised and measured at the present value of the lease payments for the right to use the underlying asset during the lease term (IFRS 16.26-27). These payments include:

- Fixed payments , less any lease incentives receivable,

- Variable lease payments that depend on an index or a rate,

- Amounts the lessee expects to pay under residual value guarantees,

- Exercise price of a purchase option if the lessee is reasonably certain to exercise that option; and

- Penalty payments for lease termination if the lease term reflects the lessee’s choice to terminate the lease.

An example of the initial measurement of the right-of-use asset and lease liability can be found in earlier sections. Please also refer to Example 13 accompanying IFRS 16.

Fixed payments

Fixed payments refer to the sums paid by a lessee to a lessor for the right to use an underlying asset during the lease term, excluding variable lease payments (IFRS 16 Appendix A).

Variable lease payments

Variable lease payments are a portion of payments made by a lessee to a lessor during the lease term that can change due to changes in facts or circumstances occurring after the commencement date, excluding passage of time (IFRS 16 Appendix A). It’s important to remember that not all variable payments are included in the measurement of lease liability and right-of-use assets. Only those variable payments tied to an index or a rate are considered in both initial and subsequent measurements. These payments could be tied to a predetermined index (e.g., CPI), benchmark rate (e.g., LIBOR), or may fluctuate to mirror changes in market rental rates (IFRS 16.28).

In the initial recognition of lease liability, variable lease payments are measured using the actual value of an index or a rate at the commencement date (IFRS 16.27(b)). This implies that the lessee cannot use forward rates or forecasting techniques in measuring variable lease payments (IFRS 16.BC166).

Variable payments that are independent of an index or a rate, particularly those tied to the future activity of a lessee or a leased asset, are excluded from the measurement of lease liability and right-of-use asset. These are recognised in P/L (or capitalised in another asset’s cost) in the period in which the event or condition that triggers the payments occurs (IFRS 16.38(b)). Typical examples of such payments recognised in P/L as they occur include:

- Payments tied to the performance of the leased asset (e.g., a specified % of revenue, physical output of the leased asset),

- Payments for specific units related to future usage (e.g., specified mileage of a leased car),

- Payments linked to taxes or levies imposed on the leased asset (see this forums post ).

Please see paragraphs IFRS 16.BC168-BC169 for more discussion and Example 14 accompanying IFRS 16.

Please note that some variable lease payments may actually be in-substance fixed lease payments .

In-substance fixed lease payments

Fixed payments may also include those that, though variable in form, are unavoidable in reality. These payments are referred to as ‘in-substance fixed lease payments’ and are further discussed in IFRS 16.B42.

Example: In-substance fixed lease payments

Retailer A signs a five-year lease for retail space. The fixed monthly lease payments amount to only $50, but this increases to $1,000 if the revenue from the point of sale situated on the leased space surpasses $3,000 per month. Retailer A must keep the point of sale open for at least eight hours a day. The likelihood of revenue not exceeding $3,000 per month is remote.

According to IFRS 16.B42(a)(ii), in-substance fixed payments are payments originally structured as variable lease payments linked to the use of the underlying asset, but their variability is resolved at some point after the start date, thus making the payments fixed for the remainder of the lease term. These payments turn into in-substance fixed payments when the variability is resolved and are then recognised in the lease liability and RoU asset.

In the scenario outlined above, Retailer A recognises a lease liability composed of monthly lease payments of $1,000 as there is no real variability in these lease payments.

Retailer B signs a four-year lease for retail space with no fixed lease payments. Instead, Retailer B pays the lessor a variable lease fee equivalent to 4% of revenue generated from the point of sale situated on the leased space.

In this case, the lease payments exhibit genuine variability. Hence, there are no lease payments to include in the lease liability measurement. Instead, the variable lease fee is charged directly to P/L every month.

VAT and other non-recoverable taxes

IFRS 16 does not provide guidance on the treatment of VAT, sales tax, and similar taxes imposed on lease payments (all these taxes are referred to as ‘VAT’ in this section). When VAT can be reclaimed from tax authorities via some form of tax returns, the accounting is straightforward: VAT is recognised as a receivable from, or payable to, tax authorities when the obligation arises. It becomes more complex when such taxes cannot be reclaimed.

As VAT is a levy imposed by the government, it falls under the scope of IFRIC 21 . Consequently, VAT payments not being lease payments made by the lessee to the lessor in exchange for the right to use an underlying asset should be excluded from the lease liability. Instead, they should be expensed in the P/L immediately when they are due. VAT can be added to RoU’s initial recognition amount as initial direct costs , but only if the VAT is payable upfront at the commencement of the lease. For more information, refer to this staff paper and this topic .

Residual value guarantees

A residual value guarantee is an assurance to a lessor that the value of an asset at the end of a lease will be a minimum specified amount. The estimated payments by the lessee under such guarantees are included in the initial measurement of a lease liability (IFRS 16.27(c)).

Purchase option

If the lessee is reasonably certain to exercise a purchase option, the exercise price of this option is included in the initial measurement of a lease liability. The same criteria used for assessing lease term should be applied when determining whether a lessee is reasonably certain to exercise the option.

Non-lease components

Payments relating to non-lease components are excluded from the measurement of lease liability, unless the lessee applies this practical expedient .

Discount rate

Determining the discount rate.

In measuring lease liability, lease payments are discounted using the interest rate implicit in the lease, assuming this rate can be readily determined. However, IFRS 16 doesn’t define what ‘readily determined’ means. One possible interpretation could be that a rate is easily determinable if its calculation does not require significant estimates or assumptions.

More often than not, lessees find it difficult to readily determine the rate implicit in the lease, primarily because it is influenced by factors only the lessors know (e.g. lessor’s initial direct costs). Furthermore, this implicit interest rate differs from the rate explicitly stated in the lease contract. Consequently, lessees typically use their incremental borrowing rates , as permitted by IFRS 16.26.

Interest rate implicit in the lease

The interest rate implicit in the lease is a rate that makes the present value of both (a) the lease payments and (b) the unguaranteed residual value equivalent to the sum of (i) the fair value of the underlying asset and (ii) any initial direct costs of the lessor (IFRS 16 Appendix A).

The unguaranteed residual value refers to the part of the residual value of the underlying asset, the realisation of which is uncertain for the lessor or is guaranteed solely by a party related to the lessor (IFRS 16 Appendix A).

As previously noted, it’s rare for a lessee to easily determine the implicit interest rate, thus they often resort to using the incremental borrowing rate. You can find an example of the calculation of an interest rate implicit in the lease on the page on lessor accounting.

Incremental borrowing rate

The lessee’s incremental borrowing rate is the interest rate a lessee would need to pay to borrow, over a similar term and with comparable security, the funds required to obtain an asset of similar value to the right-of-use asset in a comparable economic environment (IFRS 16 Appendix A). A rate that can be readily observed is typically used as a starting point when determining the incremental borrowing rate (IFRS 16.BC162). This observable rate might be an entity’s actual borrowing rate or a property yield for property leases. Entities may also use their cost of debt .

This observable rate must then be adjusted to reflect the maturity profile of a lease and the type of asset being leased.

In situations where a subsidiary uses financing centralised by a parent, the actual borrowing rate should be adjusted to account for differences in the credit ratings of these entities.

For lease payments denominated in foreign currency, the discount rate appropriate for that specific foreign currency should be used.

Lease commencement date

A right-of-use asset and the related lease liability are recognised at the commencement date, defined as the date a lessor makes an underlying asset available for use by the lessee. For recognition purposes, it’s not the lease agreement date or commitment date that matters (i.e., lease inception), but rather the lease commencement date (IFRS 16.BC141-BC144). Lease commencement and inception dates are defined in Appendix A to IFRS 16.

It might seem counter-intuitive, but in some instances, the lease commencement date can occur before the date specified in the lease contract. For example, a lessee may take control of the leased space and use it for constructing leasehold improvements before deploying it for operational activity. In such cases, the start of lease payments or the date specified in the contract does not impact the IFRS-compliant lease commencement date. If the lease commencement date determined under IFRS 16 precedes the payment initiation, the right-of-use asset and related liability should be recognised at the commencement date. The gap between this date and when the payments begin should be treated as a ‘ rent-free ‘ period (IFRS 16.B36).

Subsequent measurement of the right-of-use asset

The right-of-use asset is typically measured at cost unless the lessee opts to apply the fair value model as per IAS 40 or the revaluation model under IAS 16 (as per IFRS 16.29).

Elements of cost

Under the cost model, the subsequent measurement of a right-of-use asset is its cost, after deducting any depreciation and accumulated impairment losses (IFRS 16.30). This cost is then subsequently adjusted to reflect any remeasurements of the lease liability due to reassessments or modifications to the lease.

Depreciation

The RoU asset is depreciated according to the requirements set forth in IAS 16 (IFRS 16.31). The depreciation period for RoU should not extend beyond the lease term, except when the lease agreement provides for the transfer of the underlying asset’s ownership to the lessee at the lease term’s end, or if the cost of the right-of-use asset indicates that the lessee intends to exercise a purchase option (IFRS 16.32).

Right-of-use assets are subject to impairment requirements of IAS 36 . Typically, RoU assets are integrated into a cash generating unit and, as such, are not individually tested for impairment. For further details, refer to this comprehensive publication by EY.

Fair value and revaluation model

If a lessee applies the fair value model to its investment properties, this same accounting approach should be applied to RoU assets that are classified as investment property under IAS 40 (IFRS 16.34).

Furthermore, if a lessee uses the revaluation model for property, plant, and equipment under IAS 16, they may choose to apply this model to all RoU assets associated with the same class of PP&E (IFRS 16.35).

Subsequent measurement of the lease liability

Following initial recognition, the measurement of a lease liability is influenced by the following factors as per IFRS 16.36:

- Interest accrued on the lease liability,

- Lease payments made, and

- Remeasurements due to any reassessment or lease modifications .

Accruing interest on the lease liability

Lease liabilities are measured on an amortised cost basis, similar to other financial liabilities, as stated in IFRS 16.37. Interest is recognised in P/L unless it can be capitalised under IAS 23 .

Lease payments

Lease payments reduce the carrying amount of the lease liability. Variable lease payments not included in the initial measurement are recognised in P/L when the event or condition triggering these payments occurs.

Reassessments of the lease liability

Reassessments of lease liability are treated as adjustments to the RoU asset. If the carrying amount decreases to zero, any further reduction is immediately recognised in P/L as mandated by IFRS 16.39.

The lease liability is reassessed under the following circumstances (IFRS 16.40,42):

- Change in the lease term assessment.

- Reassessment of an option to purchase the underlying asset.

- Revision to the amounts expected to be payable under a residual value guarantee .

- Adjustment to future lease payments resulting from a change in an index or rate used to determine those payments.

Reassessments under points 1 and 2 require a revised discount rate, while those under points 3 and 4 use the original discount rate. However, if the reassessment under point 4 is triggered by a change in floating interest rates, a revised discount rate is used (IFRS 16.41,43).

Note that reassessments are different from remeasurements resulting from lease modifications.

Example: Reassessment of the lease term with updated discount rate

In this example, we will reuse the data from the initial recognition example . Let’s assume that the lease term is reassessed at the end of year 20X6 and extended to 31 December 20Y5. The payments for years 20Y1-20Y5 will be $55,000, and the discount rate is also revised upwards from 5% to 6%. On the reassessment date, the entity determines the lease liability’s present value to be $378,111. All calculations are available for download in an Excel file .

Prior to reassessment, the lease liability was valued at $186,151 (value at the end of year 20X6, refer to the initial recognition example ). The entity should recognise the increase in lease liability as follows:

The resulting entries increase the value of the RoU asset to $360,102 (which was $168,141 at the end of year 20X6). The subsequent accounting schedules for the lease liability and right-of-use asset are presented below.

Lease liability:

Changes in an index or a rate

Variable lease payments linked to an index or a rate are reassessed when future lease payments change. In other words, the adjustment is recognised only when the change to lease payments takes effect (IFRS 16.BC188-BC190).

Foreign currency exchange

IFRS 16 does not provide specific provisions regarding the impact of foreign currency exchange differences on lease liabilities. Consequently, general IAS 21 provisions apply. Particularly, this implies that the right-of-use asset’s value cannot be adjusted by the foreign currency exchange differences arising on lease liabilities (IFRS 16.BC196-BC199).

Consolidation procedures for intragroup leases

Accounting for leases differs considerably between lessees and lessors , which often complicates the preparation of consolidated financial statements for groups involved in intragroup leases. Regrettably, this issue doesn’t have a straightforward resolution.

One approach to address this issue is that, within the consolidation journal alone, the lessee could treat the lease contract as a traditional operating lease. This method could facilitate automatic intragroup eliminations by the consolidation software.

An alternative strategy could involve the consolidation team manually reversing all balances related to the intragroup leases, thereby cancelling out lease income against the depreciation of the right-of-use asset and associated finance costs. It’s important to note that these amounts won’t be identical. Therefore, any discrepancies must be tracked and accounted for within retained earnings until the lease period concludes.

For additional information on this topic, please refer to the summary provided by KPMG.

More about IFRS 16

See other pages relating to IFRS 16:

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

How to present leases under IFRS 16 in the statement of cash flows (IAS 7)

The new lease standard IFRS 16 has been here for a while and yes, it imposed a challenges on all companies who leased their assets under operating leases.

The reason is that IFRS 16 requires presenting ALL the leases in the same way , regardless whether they were classified as finance or operating.

Just for the lessees though and with some exceptions (small leases, short-term leases).

So, now, if you have any sort of a lease as a lessee, you have to present right-of-use asset and the lease liability. You can read more about it here and there are also detailed explanations with solved excel examples inside the IFRS Kit .

On top of challenges this new treatment brings , many of you asked me to show how to present these new leases in the statement of cash flows.

Hence let me show you on the solved example.

Example: IFRS 16 Leases in the statement of cash flows (IAS 7)

On 1 January 20X4, ABC entered into the lease contract. The details are as follows:

- the present value of the lease liability is CU 17 000; and

- initial direct costs paid in cash are CU 3 000.

- the repayment of the lease liability was CU 3 209; and

- the payment of the related interest was CU 491.

- In 20X4, amortization of ROU asset was CU 4 000.

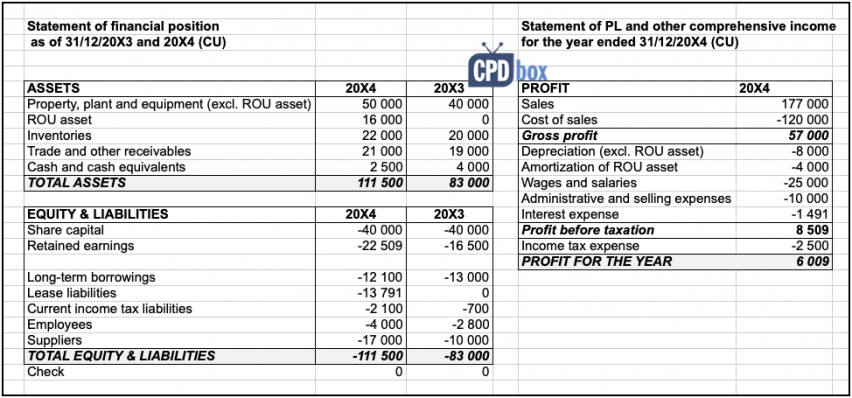

This transaction has been incorporated to financial statements as shown below.

Your task is to prepare the statement of cash flows for the year ended 31 December 20X4.

To prevent any misunderstanding, “CU” simply means currency unit (instead of mentioning EUR, USD, JPY, what have you).

Please note the following points in the presented financial statements:

- The right-of-use (ROU) asset as of 31 December 20X4 amounts to CU 16 000 in the statement of financial position, which is the initial ROU asset of CU 20 000 less amortization of ROU asset in 20X4 of CU 4 000. You can see the amortization of ROU asset of CU 4 000 in the statement of PL and OCI, too.

- The lease liability as of 31 December 20X4 amounts to CU 13 791 in the statement of financial position, which is the initial lease liability of CU 17 000 less its repayment in 20X4 amounting to CU 3 209.

- Interest expense for the year 20X4 of CU 1 491 includes the amount of interest paid on the lease liabilities of CU 491.

Solution: Preparing the statement of cash flows

Before I start with actual steps of making this particular statement of cash flows, let me point you to one of my other articles in which I described all the steps with lots of details.

I always use this method of preparing statement of cash flows as it is simple, logical, easy to follow and always gives good results.

If you are unsure how to do that, I sincerely recommend reading that article first and watching the 14-minute video at the end of it with basic explanations of making statement of cash flows.

From now on, I am going to follow the exact same steps, so I will describe them just in short.

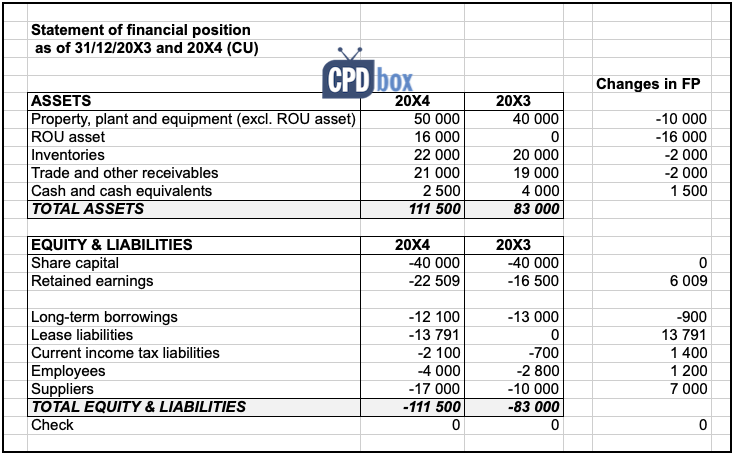

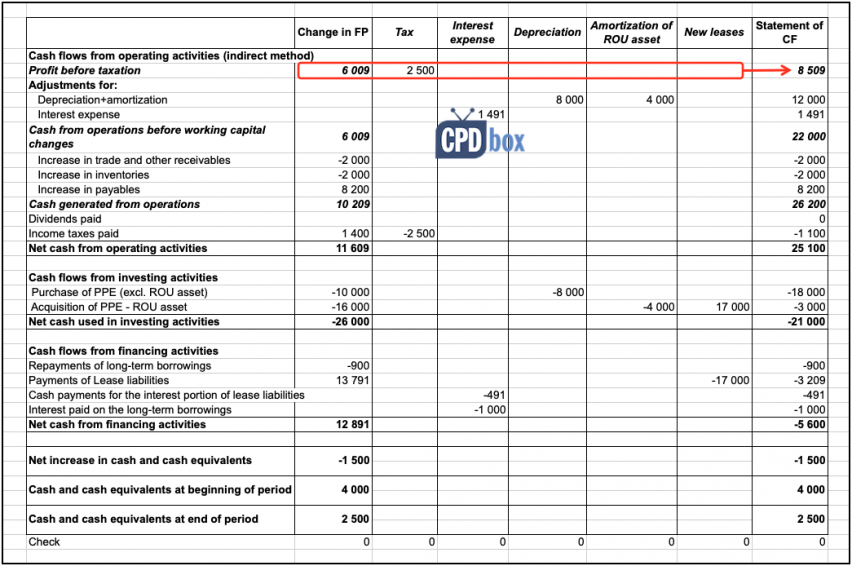

Step #1: Calculate changes in the statement of FP

Here, you will simply calculate the difference between opening balance and the closing balance of each individual item in the statement of financial position (FP). A few tips:

- Please do not mess with signs: I always use “+” for assets and “-“ for equity and liabilities.

- And, please always do opening balance less closing balance, not vice versa.

- Do NOT include subtotals.

This should look something like the following picture:

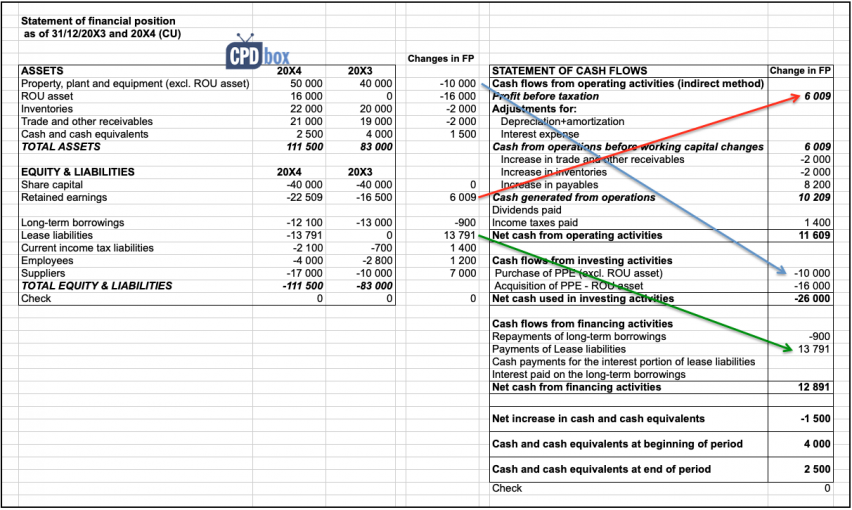

Step #2: Classify each change in FP to the statement of cash flows

Each change in the statement of FP affects the statement of cash flows somehow.

The point of this step is to assign each change in FP to the correct place within the statement of cash flows. Therefore:

- Take the blank statement of cash flows with no numbers;

- Go and classify each change in the correct place within the statement of cash flows, one by one, EXCEPT for cash and cash equivalents;

- Put the opening balance (20X3) of cash and cash equivalents to the line “Cash and cash equivalents at the beginning of the period”;

- Put the closing balance (20X4) of cash and cash equivalents to the line “Cash and cash equivalents at the end of the period”;

- Make the following check : sum of all changes without subtotals should give you the difference between the last 2 lines of your CF statement.

The following picture shows this step. I even pointed to 3 changes to illustrate what I meant by the classification of each change:

Do not worry if the numbers make no sense – that’s OK at this stage, they will make sense as we go further.

In relation to presenting your new leases in the statement of cash flows, please note:

- Change in ROU asset of CU – 16 000 was classified into the Cash flow from investing activities and since this is a minus, that points to cash paid (not received) and I labeled it as ”Acquisition of ROU asset”. Before you start making a point that ABC did not pay CU 16 000 for the acquisition of ROU asset, hang on a minute – we have not finished yet.

- Change in the lease liabilities of CU 13 791 was classified into the Cash flow from financing activities and since it is a plus, it means that the cash was received (not paid). Again, if it makes no sense at this stage, that’s OK – it will at the end.

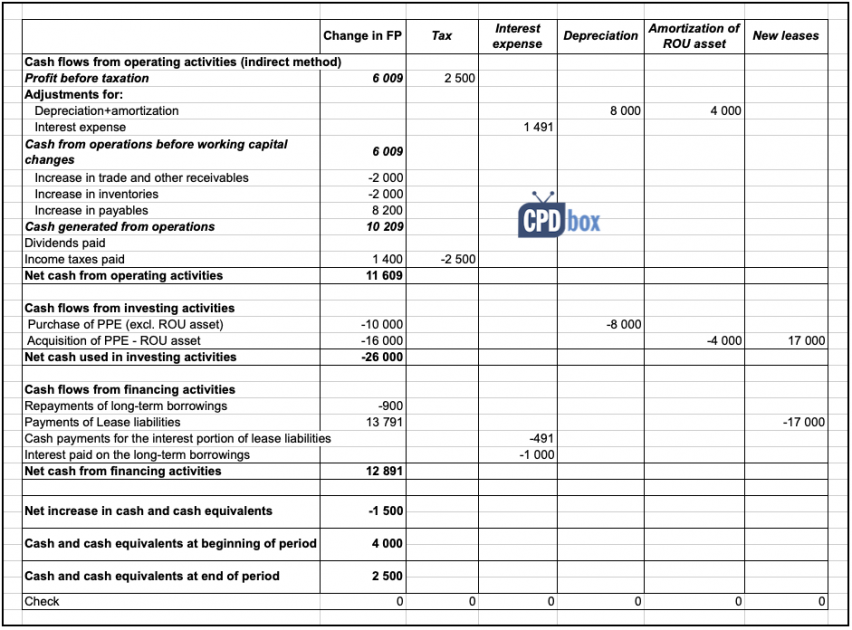

Step #3: Deal with non-cash items

This is the crucial part to understand and get it right, especially in the case of leases under IFRS 16, because taking a lease is a non-cash item at the initial recognition.

Before we start actually working on adjustments for non-cash items, here are a few tips:

- Make each adjustment in a separate column.

- Making adjustment means adding a number to certain line item and deducting it from the other one, so that it’s total is always zero.

OK, for this example, let’s do just a few adjustments, namely the one for tax expense (which is universal crucial adjustment for ALL statements of cash flows), interest expense, depreciation and then all adjustments related to leases only (we will pretend there are no other adjustments.

Adjustment #3.1: Tax expense

You can see that currently, your CF statement starts with profit before tax, but in fact, there is a balance of CU 6 009 which is profit after tax in fact (just look at the statement of PL and OCI).

Therefore, we add back the tax expense of 2 500 to the first line and deduct it from the line “income taxes paid”.

If there were some unsettled income tax liabilities or deferred tax assets/liabilities, then you should adjust them as well, but let’s keep it simple here. You can always take a look at the IFRS Kit where you will learn all the details.

Adjustment #3.2: Interest expense

Interest expense always adjusts non-cash items in the operating part, therefore we add its amount of CU 1 491 accordingly to the line “Adjustments for: interest expense”.

The standard IAS 7 equires presenting interest paid either in the operating part or in the financing part (well if you work for a bank or other financial institution, then you do not have this dilemma because it is clearly the operating part in most cases).

Let me also bring your attention to the requirement of paragraph 50 of the standard IFRS 16. It requires that you shall classify the cash payments for the interest portion of the lease liability separately in the statement of cash flows.

Therefore, I split the total interest paid into two parts:

- Cash payments for the interest portion of the lease liabilities: CU – 491; and

- Interest paid on the long-term borrowings (not related to leases): CU – 1 000.

As you can see below, I decided to classify the interest paid in the financing part rather than operating one, although you have a choice.

Adjustment #3.3: Depreciation

This is clearly non-cash item included in your profit, so you need to add it back in the line “Adjustments for: depreciation and amortization” in the operating part.

You should deduct it then from the same line item in which you reported the change in FP related to property, plant and equipment in the investing part.

Adjustment #3.4: Amortization of ROU asset

Again, this adjustment is of a very similar character as depreciation (#3.3).

You need to add the amount of CU 4 000 back in the “Adjustments for: depreciation and amortization” in the operating part.

Then, you deduct it in the same line in which you classified the change in ROU asset: Acquisition of PPE – ROU asset.

Adjustment #3.5: New leases

As I have mentioned above, acquisition of assets under the leases are non-cash item initially, therefore we need to adjust it.

So, initial change of ROU asset amounted to CU 20 000 (prior amortization), but ABC paid only CU 3 000 for the initial cost. The rest of it was new lease liabilities, that are also non-cash item.

Therefore, you need to cancel these 2 non-cash items, so you need to:

- Add back the non-cash amount of acquiring new ROU asset of CU 17 000;

- Deduct the non-cash amount of acquiring new lease liabilities of CU – 17 000.

That’s it, we are done with non-cash items for leases.

It looks as follows:

Step #4: Add up

At this stage, you are almost done.

Just add up all the columns , line by line, to get the actual statement of cash flows.

For example, take a look at the line “Profit before taxation”. You need to add up all the numbers from all the columns in that line, in this case CU 6 009 plus CU 2 500, which is CU 8 509 – exactly as Profit before tax from your statement of PL and OCI.

On top of that, it would be nice to add subtotals to show totals for individual parts of statement of cash flows clearly.

I have done that for you, here you go:

Step #5: Perform final checks

Let’s take a look at some final numbers related to leases in the statement of cash flows to see if they make sense:

- Acquisition of PPE – ROU asset: The final statement of cash flows shows the amount of CU 3 000. This is OK, because ABC paid CU 3 000 for initial direct costs related to the lease. The remaining part of ROU asset was financed by the lease itself (not cash).

- Payments of lease liabilities: The statement shows the amount of CU 3 209. This is OK since ABC repaid CU 3 700 within the lease payments, thereof CU 3 209 for the reduction of the lease liability (please take a look at the question above).

- Cash payments for the interest portion of lease liabilities: : The statement shows the amount of CU 491, presented separately from other types of interest paid and this amount corresponds with the numbers in the question above.

When you are preparing complex statement of cash flows, I also recommend verifying the movement of certain balance sheet items. I am not going to do that here in this article as the movements are clear enough from the statement, but if interested, check out this article again (step 6) or take a look inside the IFRS Kit.

The following video shows this process, so please check that out:

The excel file from this video is included in the IFRS Kit .

Any ideas or questions? Feel free to comment below. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

29 Comments

Hi Silvia, I have questions regarding treatment of lease under RoU and Finance Lease for project cash flow/Discounted Cash Flow. From my understanding, the amount reported for RoU as ‘Acquisition of RoU’ in the audited Statement of Cash Flow does not necessarily mean there is actual cash outflow occured at that point of time. The RoU represents the PV of lease payments. The real cash outflow happened via the annual payments of lease liability and is presented in the CF under the Financing Activities. Please advise.

If that is the case, in preparing my project CF using the DCF method, do I have to: 1. exclude acquisition of RoU from the investing activities? 2. include the payment of lease liability (for RoU and Hire purchase) in the investing activities or financing activities?

Please advise.

Thank you so much!

Dear Mahima, I think that this article gives quite a good response in that. Please revise step #3, adjustment 3.4 (and prior adjustments, too). Thank you!

Hi Silvia, I do agree in posting the “Cash payments for the interest portion of lease liabilities” in the “Cash Flows from financing activities” but, in financial literature, I often read that the interest portion should go in the Cash Flow from Operating Activities. What is your opinion? Which of the two possibilities is the best one and why? Many thanks!

Dear Vittorio, thank you for this comment. In fact, IAS 7 gives you the choice, when it comes to presenting the interest paid: either in financing or in operating activities, according to what is more relevant to your situation. So there is no black or white answer to that. Thank you!

Hi Silvia, Appreciate your write up. I’m wondering how will early termination of lease be presented in Cash Flow? Thanks

Hi Elaine, it depends. I would need to see the specific balances in the books prior termination and go from there. S.

Hi Silvia, this is wonderful work. It was really helpful. Thank you

Hi Silvia, Thank you for this. Surely now our operating cash flow is incomparable to prior periods as we are effectively paying our rent out of financing activities. Adding back Depreciation and Interest to net income to reach OCF would be inflating the cash flow generate. The company would not be able to generate operating cash flow without its premises so I am slightly confused. thanks,

No, adding back depreciation and interest to the net income to reach OCF foes NOT inflate the cash flows. The opposite is true – that enables you to see the real cash flows from operating activities. And yes, I understand your point about categorizing rent as financing activity – but as soon as you take the asset under the lease and create ROU, then you are financing your business, because effectively you took a loan (lease).

Thank you very much, Silvia

Thanks for your efforts, Silvia, you are explaining it in a simple way,

Hello, thank you for the detailed example. However, I don’t understand why the cash payments for the interest portion of lease liabilities is presented separately from interest on long-term borrowings. IAS 7 paragraph 32 requires the total interest paid to be disclosed in the statement of cash flows, which implies that the two amounts should be summed and presented in a single line. IFRS 16 paragraph 50 just requires that the requirements of IAS 7 for interest paid be applied to the cash payments for the interest portion of lease liabilities – it doesn’t seem to suggest it needs to presented separately from other interest paid. Paragraph 53 has other specific disclosures such as to disclose the interest expense and the total cash outflow, but those are usually covered within the notes. Some of the Big 4 model/illustrative financial statements do not appear to separate the interest paid on lease liabilities from other interest paid in the statement of cash flows.

The above is in connection with the following part of the article: “paragraph 50 of the standard IFRS 16. It requires that you shall classify the cash payments for the interest portion of the lease liability separately in the statement of cash flows. Therefore, I split the total interest paid into two parts:” .

Thanks for the comment. Actually I discussed the same issue with my colleagues because indeed it seems that there are different interpretations of both IAS 7.32 (which in my opinion does not prevent you from splitting the amount of interest paid as soon as you include the total amount) and IFRS 16.50 and I would agree that if the interest paid on lease liabilities is not material, it is perhaps OK not to split the amount of total interest. Anyway it is not the major issue though.

Hello please is it safe to conclude that the interest expense on lease liability will be similar to the amount recognized as cash payments for the interest portion of the lease liability (IFRS 16.50) in the statement of cash flows.

Hello Silva, nice article as always!! Please is it safe to conclude that in all cases, the interest expense on Lease liability will be same as the cash payments for the interest portion of the lease liability(required by IFRS 16 paragraph 50)?

Not always. I assume cash payments are in line with the lease contract (sometimes it will state the schedule with listing the cash payments), but accounting can differ due to the items not taken into account in the contract. So I would be careful in making similar assumption.

Hi, I am paid customer for the IFRS box but I could not locate the excel file you mentioned in the article as a part of the ifrs kit. Can you help me locate the file ?

Thank you Silva for this Great write-up. Do you agree with the position that lease payments made on or before commencement date and capitalized directly to the Right of Use assets should be recognized as Cash outflow under “Investing Activities”. I’m relying on the definition of Investing activities in IAS 7 which requires that they cover activities relating to acquisition/disposal of long term assets.

Hi Olayinka, frankly speaking I did not give it a thought, but your arguments are valid.

Another real life situation: VAT. Invoices from lessors for the lease of RoU asset include it, so how do you handle that? Ignore it and keep posting the vendor liabitiliy to the AP accounts or complacate?

You made it easy . Thanks a lot

I do appreciate the way you conduct lectures on IFRSs. Keep it up

Hello, Hi, There I am Very Grateful That You Provide me Short and Brief Explanation About IFRS.. So Please Keep It Up The Good Work.

Thank you 🙂

Thanks you very much Sylvia. Your work is excellent because it brings these sometimes obscure accounting issues to life. Cash flow statement construction so that it ties out with the year on year change in cash is always challenging.

Hello all…at the end of the day, analysts need to know what the cash rental expense is so that it can flow to the DCF model. Assuming no short term leases not capitalized in the above example, we have to use depreciation and interest as a proxy for the actual rental payment. This comes to 4000 + 491 = 4491. The cash payment, based on the CFS above is 3700…so which one is correct? The balance sheet numbers are dependent on assumptions for interest rates and lease life, which also impact the notional interest and amortization, and if these change from year to year it will change the balance sheet numbers making the year on year change look like a cash event when it is not…or maybe it is. Also, the liabilities almost never equal the asset values and the balance goes to equity. The extent of this balancing amount depends on the age of the lease portfolio. Welcome to IFRS 16…we have lots of information, all of it non-cash, which is of little use to analysts and to cap it all…companies no longer report the actual rental expense, the very number which is needed.

Hi Greg, all good points. However, do not deem this example as real-life, under commercial fair value terms. I made it up out of thin air just to illustrate the concept and to put some numbers into it. Maybe under the commercial terms, “4491” would come closer to “3700”.

Thank you so much, Silvia! Allways your articles so clear and useful!

Leave a Reply Cancel reply

Recent Comments

- Silvia on IFRS 15 vs. IAS 18: Huge Change Is Here!

- Mo on IFRS 15 vs. IAS 18: Huge Change Is Here!

- Silvia on Depreciation of ROU related to land

- Pauline on Depreciation of ROU related to land

- ahmed on IFRS 3 Business Combinations

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

JOIN OUR FREE NEWSLETTER

report “Top 7 IFRS Mistakes” + free IFRS mini-course

1514305265169 -->

We use cookies to offer useful features and measure performance to improve your experience. By clicking "Accept" you agree to the categories of cookies you have selected. You can find further information here .

Virtual Summit May 21st: Earn 3 CPE Credits | Register Now

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures

by Abdi Ali, Sr. Technical Accounting Manager | Feb 6, 2021

IFRS 16 leases

What is considered a lease under ifrs 16.

2. IFRS 16 finance lease example (lessee)

Amortization schedule

Journal entries.

3. IFRS 16 disclosures

IFRS 16 summary

Companies previously following the lease accounting guidance under IAS 17 likely transitioned to IFRS 16 during their 2019 fiscal year, in accordance with the standard’s effective date of January 1, 2019, for annual reporting periods beginning on or after that date. Therefore, the standard is now effective for all organizations following international accounting standards.

This article will walk through the key changes between the lessee accounting model under IAS 17 and IFRS 16 and also provide a comprehensive example of lessee accounting under IFRS 16. The lessor accounting model under IFRS 16 remains relatively unchanged from IAS 17 and will not be covered in this article.

Note: This article has been updated for the benefit of organizations who have already transitioned to IFRS 16. Click here to read or download the previous version of this article, which includes two transition examples .

Within the lessee accounting model under IFRS 16, there is no longer a classification distinction between operating and finance leases. Rather, now a single model approach exists whereby all lessee leases post-adoption are reported as finance leases. These leases are capitalized and presented on the balance sheet as both assets, known as the right-of-use ( ROU ) asset , and liabilities, unless subject to any of the exemptions prescribed by the standard.

Similar to finance lease accounting under IAS 17, the accounting treatment for finance leases under IFRS 16 results in the recognition of both depreciation and interest expense on the income statement. For those entities dually reporting under both IFRS 16 and ASC 842, you will notice that the accounting for finance leases under IFRS 16 resembles the accounting for finance leases under ASC 842 . However, ASC 842 still retains the operating lease classification .

In conjunction with the change in the lessee’s financial statement presentation, IFRS 16 also requires more robust disclosures.

Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in exchange for agreed-upon consideration. To determine whether a contract grants control of the asset to the lessee, the agreement must provide the following to the lessee:

- The right to substantially all economic benefits from the use of the asset

- The right to dictate how the asset is used by the entity

At times, an organization may have a contract that seems to meet the definition of a lease but does not fall within the scope of IFRS 16. Situations where this may occur include but are not limited to:

- Leases of biological assets

- Leases for the exploration of non-regenerative resources such as oil, gas, etc .

- Service concession arrangements

- Licenses of intellectual property

Concurrently, lessees reporting under IFRS 16 may choose to take advantage of practical expedients that exclude certain types of leases from capitalization. These include:

- Short-term leases, defined as having a term of 12 months or less at commencement and no option to purchase the leased asset

- Leases of low-value assets, defined as leases for which the underlying asset’s fair value (when the asset is new) is generally less than $5,000

Note: Please refer to our blog on practical expedients for more details on IFRS 16 expedients

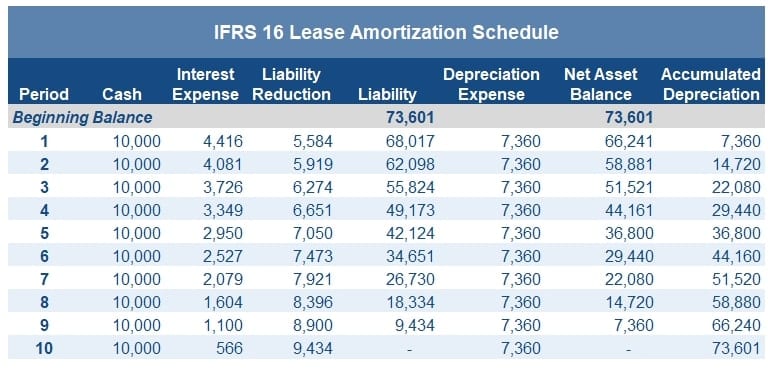

IFRS 16 finance lease example

Since the majority of entities reporting under IFRS have already adopted IFRS 16, we will bypass a discussion of the various adoption methods and jump right into the accounting. For a breakdown of different adoption methods, please refer to our IFRS 16 detailed walkthrough.

In the example below, we’ll outline the steps to calculate the lessee’s opening lease liability and ROU asset and present the complete amortization schedule, followed by the initial transition journal entry and the journal entry for the first period’s activity.

Commencement Date : January 1, 2021 Lease Term: 10 years Lease Payment (paid in arrears): $10,000 annually Lessee’s Incremental Borrowing Rate : 6% Useful Life of Underlying Asset: 25 years

If you’re a small business and looking to report under IFRS 16, you can do all of this in our new lease accounting software, LeaseGuru powered by LeaseQuery . It’s completely free to try!

Based on the facts above, we’ll take the following steps to generate the IFRS 16 amortization schedule :

- Calculate the initial lease liability as the present value of the total remaining lease payments as of the commencement date.

- Calculate the initial right-of-use asset as the lease liability at commencement plus or minus any necessary adjustments.

- Amortize the lease liability over the lease term to reflect both lease payments and interest on the liability using the effective interest method.

- Depreciate the ROU asset in a systematic and rational manner over the useful life of the underlying asset or the lease term, whichever is shorter.

Using the values noted above, the amortization schedule at the commencement date of the lease is as follows:

As we can see in the above schedule, because no adjustments were necessary to calculate the opening ROU asset at commencement, the ROU asset is equal to the lease liability. Thereafter the ROU asset is depreciated in a systematic and rational manner (e.g. straight-line in our case) over the lesser of the lease term or useful life of the underlying asset. In our example, the ROU asset is depreciated over the 10-year lease term, which is shorter than the leased asset’s useful life of 25 years.

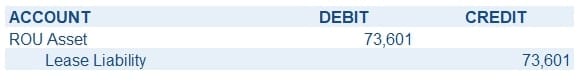

The initial journal entry under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date. Below we present the entry recorded as of 1/1/2021 for our example:

IFRS 16 disclosures

Now let’s cover the disclosure requirements for lessees under IFRS 16. Within the notes to the financial statements, an entity is expected to present both qualitative and quantitative disclosures regarding their leasing activities for the respective reporting period(s). The quantitative disclosures required by IFRS 16 for lessees include but are not limited to:

- The carrying amount of all ROU assets summarized by asset class as of the end of the reporting period

- ROU asset depreciation expense , summarized by asset class for the reporting period

- Total interest expense on lease liabilities for the reporting period

- Expenses from short-term leases not included on the balance sheet as of the end of the reporting period

- Expenses from low-value asset leases not included on the balance sheet as of the end of the reporting period or in the expense summary of short-term leases for the reporting period

- Expenses from variable lease payments excluded from the lease liability calculation

- Sublease income for the reporting period

- Any gains or losses recognized from sale-leaseback transactions

- Total cash outflows for leases

- Any ROU asset additions

- A maturity analysis of all lease liabilities as of the end of the period

Furthermore, the lessee is required to disclose certain qualitative information to help financial statement users understand the entity’s leases and leasing activities, including the following:

- Summary of leasing activities

- Commitments for leases not yet commenced (i.e. a liability is not yet recorded on the balance sheet)

Try LeaseGuru IFRS 16 accounting software for free:

LeaseGuru powered by LeaseQuery is our new IFRS 16 lease accounting software for small businesses. With this software, you can view journal entries, amortization schedules, disclosures and more. Create your free account to try it out today!

This concludes our high-level overview of IFRS 16. We introduced the key differences for lessee accounting under IAS 17 and IFRS 16, provided an example of a lessee amortization schedule and the related journal entries, and discussed the required disclosures.

Recent Searches

How do you steady the course of your IPO journey in a changing landscape?

EY Global IPO Trends Q1 2024 provides insights, facts and figures on the IPO market and implications for companies planning to go public. Learn more.

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

Artificial Intelligence

EY.ai - a unifying platform

Select your location

close expand_more

IFRS 18 changes financial performance reporting

International Director, Global IFRS Services, Ernst & Young Global Limited

Related topics

Ifrs 18 requires all companies using ifrs standards to provide relevant information that enhances transparency in their financial performance..

- IFRS 18 replaces IAS 1 and responds to investors’ demand for better information about companies' financial performance.

- New requirements include: new categories and subtotals in the statement of profit or loss, disclosure of MPMs and enhanced requirements for grouping information.

T he International Accounting Standards Board (IASB) published IFRS 18 Presentation and Disclosure in Financial Statements in April 2024. This new standard will help companies to provide information about their financial performance that is useful to users of financial statements in assessing the prospects for future net cash inflows to the company and in assessing management’s stewardship of the company’s economic resources. It represents the completion of a major standard-setting project on the presentation of financial statements and, therefore, will have significant implications for many companies reporting under IFRS.

IFRS 18 represents the most significant changes to the presentation of financial performance in recent times and requires companies to reconsider the overall structure of the statement of financial performance.

How EY can help

Audit services

We merge traditional and innovative approaches, combined with a consistent methodology, to deliver quality audit services to you. Find out more.

New features of primary financial statements

One of the key features of IFRS 18 is to require companies to classify all items of income and expenses into one of the five categories of operating, investing, financing, income taxes and discontinued operations. The first three categories are new; IFRS 18 provides specific guidance to assist preparers in identifying items to be classified in each respective category especially for companies with specified main business activities of investing in assets or providing finance to customers. The categories are complemented by the requirement to present subtotals and totals for “operating profit or loss,” “profit or loss before financing and income taxes” and “profit or loss”.

The new standard also provides that the aggregation and disaggregation of items of assets, liabilities, equity, revenue, expenses and cash flows are based on shared characteristics. Companies are required to aggregate or disaggregate items to present line items in the primary financial statements to provide useful structured summaries. Furthermore, in the notes to the financial statements, companies are required to aggregate or disaggregate items to provide material information, but in doing so, must not obscure material information.

When IFRS 18 becomes effective, it is expected that the new guidance and requirements applicable to categories, subtotals and totals will enhance their comparability across companies. For example, operating profit or loss is a defined term under IFRS 18 applicable to all companies allowing users to better understand the performance of a company’s operations and compare operating profit or loss across companies.

IFRS 18 creates an opportunity for companies to revisit and change their communication strategy for their financial performance and determine the MPMs going forward.

Management-defined performance measures (MPMs)

Another important feature of the new standard is management-defined performance measures. An MPM is a subtotal of income and expenses not listed in IFRS accounting standards, nor specifically required to be presented or disclosed by an IFRS accounting standard. Companies use MPMs in public communications outside financial statements to communicate to users management’s view of an aspect of the financial performance of the company as a whole.

Furthermore, IFRS 18 requires companies to disclose information about all their MPMs in a single note to the financial statements. It also requires disclosure of how the measure is calculated, how it provides useful information to users and a reconciliation to the most comparable subtotal specified by IFRS accounting standards.

As MPMs are required disclosures under IFRS 18, they will be subject to audit. The disclosure requirements will also enhance transparency and communication effectiveness of a company’s financial performance.

The successful implementation of IFRS 18 will require companies to update their financial statement close process and make the necessary changes to its information systems, also taking into due consideration the information needs of users of financial statements, especially investors.

Effective date and transition

IFRS 18 is effective for annual reporting periods beginning on or after 1 January 2027, and is to be applied retrospectively for comparative periods. The effective date of the standard will depend on the local regulatory requirements in different jurisdictions. Earlier application is permitted and must be disclosed in the notes. If a company applies IAS 34 Interim Financial Statements in preparing condensed interim financial statements in the first year of applying the standard, the company is required to present headings it expects to use in applying IFRS 18 and subtotals consistent with the requirements in the standard. In addition, a company is required to disclose reconciliations for each line item presented in the statement of financial performance for the comparative periods immediately preceding the current and cumulative current periods.

Between now and the date of initial application, companies will need to redesign the income statement and the cash flow statement, re-evaluate the disclosures to be included in the notes to the financial statements, restate comparatives (both annual and interim financial statements) and prepare the reconciliations for transition disclosure purposes. Companies need to plan ahead in a timely manner as the process could take considerable time and involve financial reporting, legal and investor relations personnel, among others.

IFRS 18 replaces IAS 1 Presentation of Financial Statements as the primary source of requirements in IFRS accounting standards for financial statement presentation which will provide better information to users. Some of the changes it introduces include new presentation requirements related to the statement of profit or loss, including three new categories for items of income and expense – operating, financing, investing.

IFRS 18 requires companies to improve labelling, as well as aggregation and disaggregation of information in financial statements. Companies will also need to disclose management-defined performance measure in the notes to the financial statement.

Related articles

What companies need to consider for classification of liabilities

How IFRS classifies liabilities with covenants as current or non-current is changing in January 2024. Learn more

How companies could be affected by proposed amendments to IFRS 9

A proposed change to IFRS 9 requires settlement date accounting for derecognizing financial assets and liabilities. Learn more

About this article

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

VEON Ltd. (NASDAQ:VEON) Q1 2024 Earnings Call Transcript

VEON Ltd. (NASDAQ: VEON ) Q1 2024 Earnings Call Transcript May 16, 2024

Faisal Ghori : Good afternoon and good morning to everyone. And thank you for joining us today for VEON's first quarter results presentation for the period ending March 31st, 2024. I'm Faisal Ghori, Head of Investor Relations. I'm pleased to be joined in the room today by Kaan Terzioglu, our Group CEO, along with Joop Brakenhoff, our Group CFO. Today's presentation will begin as usual with the key business highlights and business updates from Kaan, following discussion of detailed financial results by Joop, we will then open up the line for Q&A. Before getting started, I would like to remind you that we may make forward-looking statements during today's presentation, which involve certain risks and uncertainties. These statements relating, partly to the company's anticipated performance and guidance for 2024, future market developments and trends, operational network developments, and network investment, and the company's ability to realize its targets and commercial strategic initiatives, including current and future events.

Certain factors may cause actual results to differ materially from those in the forward-looking statements, including the risk detailed in the company's annual report on the Form 20-F and the other recent public filings made by the company with the SEC. The earnings release and the earnings presentation, each of which include reconciliation of non-IFRS measures presented today, can be downloaded from our website. We also note that today's presentation will include ratings from credit rating agencies. A rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. With that let me hand it over to Kaan.

Kaan Terzioglu : Thank you Faisal. Good morning, good afternoon and welcome to everyone. I appreciate you joining us today on May 16th, 4 p.m. Dubai time for our first quarter results for 2024. Today I'm excited to highlight the robust growth in U.S. Dollar revenue growth. In the first quarter of 2024, we report a 6.6% year-over-year growth in US dollars revenue. This figure is particularly notable when considering the impacts of a significant network cyberattack in Ukraine. Other than Ukraine, our organic US dollar revenue growth across all operations increased to 15% year-over-year, a mid-teens hard currency growth rate. In local currency, Ukraine declined 14% in Q1, and the rest of the operations growth accelerated to 20.5% in Q1 from an already high local currency growth rate of 19.2% year-over-year in 2023.

This exceptional performance not only underscores our leader position in the telecom business, but also highlights our performance in digital platforms and mobile financial services. Let's delve into the strategies that have driven this remarkable growth. During our presentation, I will concentrate on local currency growth rates that more accurately reflect the true underlying growth trends and operational achievements across our operating companies. Please note, local currency growth rates include the impact of recent cyberattack in Ukraine. In Q1 2024, we achieved double-digit growth at 12% year-over-year in local currency terms. Service revenues rose at a similar rate of 10% year-on-year in local currency. Other than Ukraine, revenue grew 15% year-on-year in dollars and local currency growth expanded to 20.5%.

Local currency, EBITDA, expanded in Q1 2024 at a rate of 5% year-on-year. If we isolate the Ukraine operation, EBITDA grew 16% year-on-year in US dollar terms. This is indicative of positive operating leverage and sound execution of cost management programs. Our balance sheet remains robust as well. We have a cash position of $632 million, of which $261 million is held at the headquarters. In late March, we repaid the full outstanding balance of $805 million of principal under the revolving credit facility and canceled the revolving credit facility. Later in this presentation, Joop, our Chief Financial Officer, will provide an update on our pro forma liquidity status, which takes into account the revolving credit facility repayments. Capital expenditures increased by 39% year-on-year, totaling $125 million for the first quarter.

To continue reading the Q&A session, please click here .

- Sustainability

Net revenues of Euro 1,585 million, up 10.9% versus prior year, with total shipments of 3,560 units substantially flat versus Q1 2023

Adjusted EBIT (1) of Euro 442 million, up 14.8% versus prior year, with adjusted EBIT (1) margin of 27.9%

Adjusted net profit (1) of Euro 352 million and adjusted diluted EPS (1) at Euro 1.95

Adjusted EBITDA ( 1 ) of Euro 605 million, up 12.7% versus prior year, with adjusted EBITDA (1) margin of 38.2%

Industrial free cash flow (1) generation of Euro 321 million

“The start of the year was very positive: revenues and profits recorded double-digit growth with stable deliveries. This was achieved through an even stronger product and country mix as well as a greater contribution from personalizations. Our value over volume strategy continues to be successful,” said Benedetto Vigna, CEO of Ferrari. “and within this same strategy, the execution of our business plan progresses on schedule, with the enrichment of our product range thanks to the recent launch of the 12Cilindri and 12Cilindri Spider”.

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.